I Made Over $400,000 Net Profit Selling Toys in 2025

Hello friends,

Here today with my favorite article of the year - the annual deep dive / year in review!

I’m going to take you through the highs, the lows, the mistakes, the wins, and highlight the lessons I learned running my business in 2025. I try to be as transparent as I can in this article, and I guarantee there are some interesting data points in here for everyone.

Adjacent to what my buddy Steve French said on Twitter, this is the first year where I felt like I was actually really good at what I do. I’ve always had a decent handle on things, but 2025 is where years of patience and learning have started to fully manifest. Precise buying of SKUs. Patience with repricing. Having a much better grip on the supply chain of my toys and being able to' ‘trust the process’ more than ever.

I am obviously far from perfect. I make plenty of mistakes and am not afraid of criticism. If you have interesting data points to share with me after reviewing my notes - please! Share them. Let’s improve our businesses together.

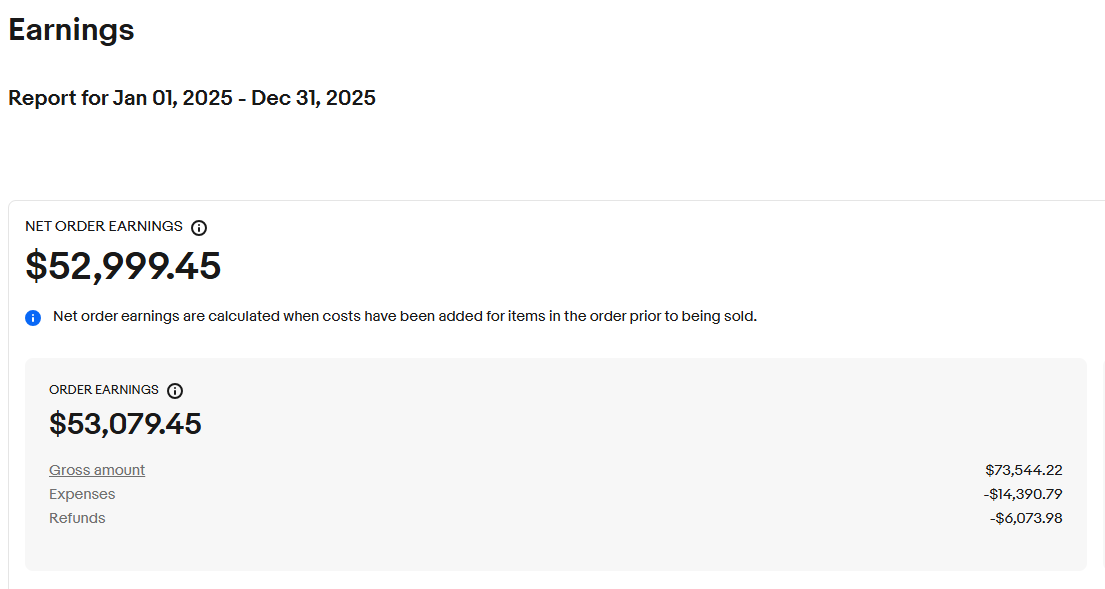

Lastly, my books are still reconciling, some software is slower than others but I want to get this article out ASAP. The numbers are pretty close to what they should look like a week or two from now, with some additional profit rolling in from Profit Cyclops since they currently have my Walmart revenue under-reported by like 60k.

With that being said, welcome to The Toy Investor 2025 Year in Review.

First off, let’s flex the ‘beach muscles’ (orange and blue bars).

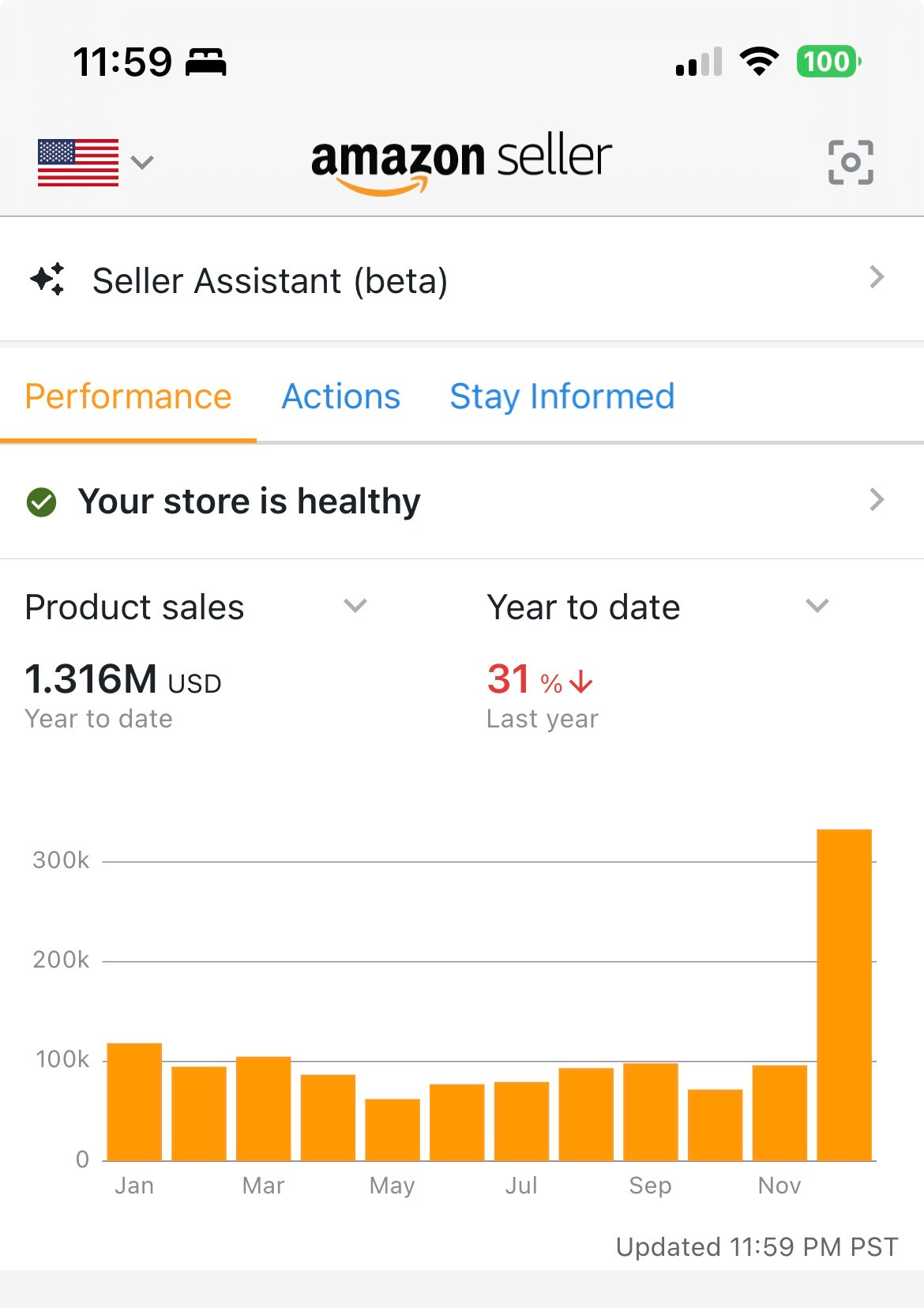

Amazon:

Down 31% YoY because I started selling on Walmart. This was my first full year selling on WM.

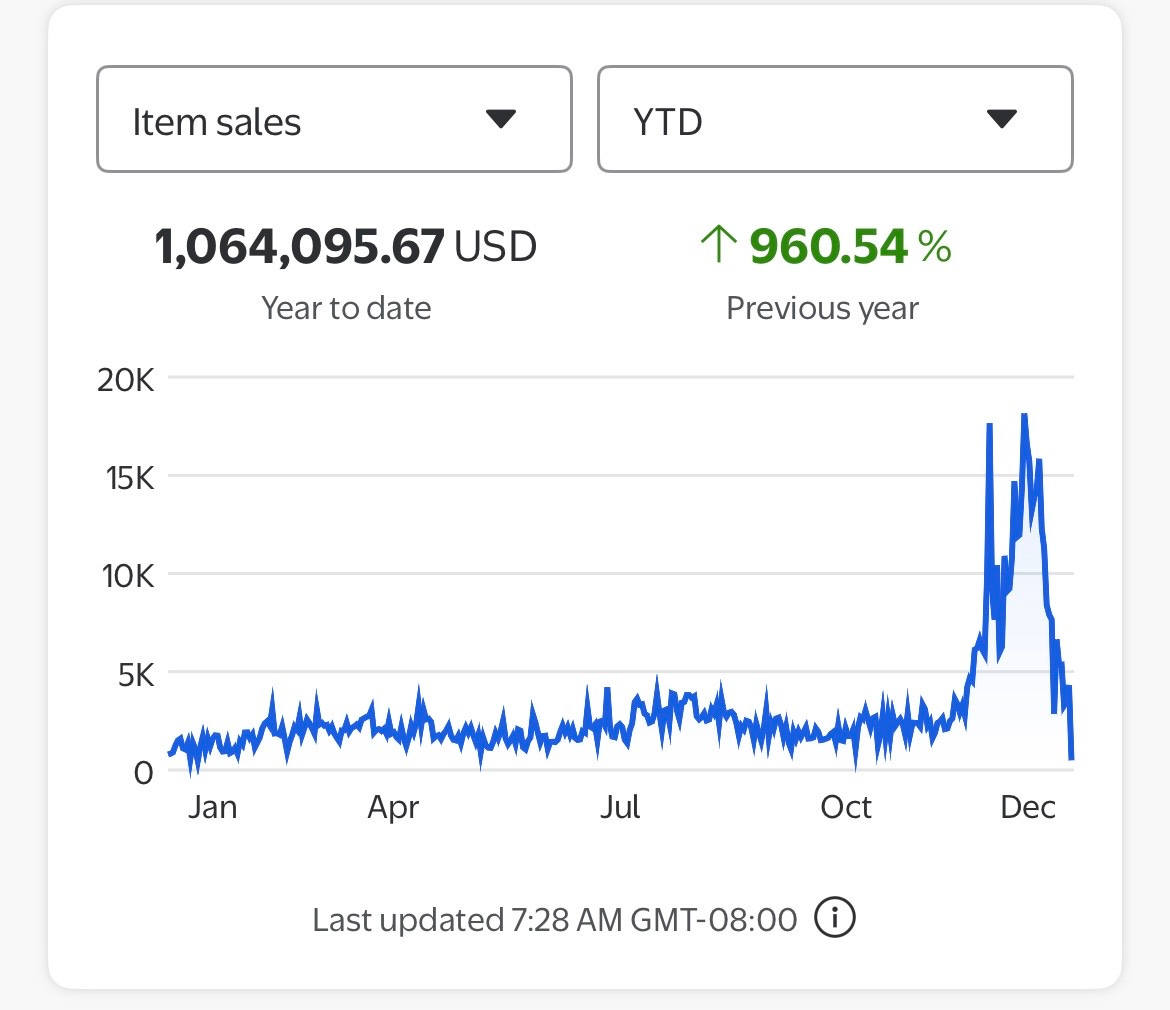

Walmart:

eBay:

That brings total sales before any fees between Amazon, Walmart, and eBay for the year to about $2,453,639.

It’s just a vanity number but it’s fun to look at!

I’m really pleased with my split between Amazon and Walmart. I know a lot of people have had issues with Walmart this year, and I don’t want to discount the issues that the platform has, but I’d be lying if I said the profit on Walmart wasn’t immensely better than Amazon.

And on top of that…

Cash back amounted to $1,206 from Rakuten, $2,835 from Top Cash Back, and about $17,000 from my credit cards.

No, I didn’t include that in my net profit in the title. I toss all those rewards into my personal account. I also didn’t include cash transactions in my profit, which is likely somewhere north of 7-8k profit as I did a lot of local Pokemon flips at card shows. Oh, and I wasn’t sneaky - I didn’t include newsletter revenue in the profit either. Don’t worry I’m not trying to inflate my numbers!

Anyways, let’s start with some of the noteworthy expenses for the year:

Amazon 30-Day Storage Fees: $15,498.09

Walmart 30-Day Storage Fees: $8,658.39

I am super stoked on these numbers. Why? Because last year my 30-day storage fees on Amazon alone were $26,493.19. This year I sold more units, and we’re coming in under those fees. Walmart’s no peak storage fee promo has been incredible, and I can only hope they continue it in 2026. They also had some random $0 storage fees with certain SKUs I was able to take advantage of.

The good news is, I can get these fees down even lower in 2026. Because I was transitioning from two storage units to a house, I had to send in thousands of units a month or two earlier than I wanted. On top of that, there were a few SKUs I was a bit over-confident on with sending them in in November even though competition was still high - oops, pointless storage fees. Now operating out of a house instead of the storage units, I have a bit more space and should be able to optimize this to reduce storage fees. Always nice to see an expense that’s within your control.

Amazon Long Term Storage Fees: $1,315.51

A massive win here. 2024 was $5,766.76 in long term storage fees. I really paid attention to this this year and the results showed.

FBA Inbound Placement Fees: $15,698.09

Walmart Inventory Transfer Fees: $4,164.45

Amazon’s inbound placement fees are an absolute gut punch to those of us on the west coast. It’s unfortunate that several times throughout the year I kept trying to avoid these by doing Amazon optimized shipments, but they kept routing 4/5 boxes to the east coast, resulting in worse costs than the inbound placement fees. Additionally, Amazon frequently has me shipping “west”, down to Arizona or up to Oregon, even though there’s an FC two hours from me.

It’s really frustrating and I want to have more control over this. I do intend to get this down, it’s just very annoying that you have to entirely adjust your workflow to pack five boxes with no guarantee you’ll actually be saving money. Regardless, I can definitely be better here.

Walmart has better shipping rates so I need to lean into their program to dodge these fees more. Will be better about this in 2026.

Storage & Rent: $21,092

Playing this game in California is definitely hard mode. My expenses even just for two storage units for the first 8 months of the year were almost $7,000! In August, an opportunity popped up where the people living across the street from my house were going to be moving and wanted to rent their house. I was paying $3,600/mo for the house/warehouse hybrid split I had going on, and I figured this would be nice to finally have a house dedicated solely for living in, and then I could keep the current house just as a ‘warehouse’. No commute for a real warehouse. No more having to travel to the storage unit. And I’d be getting some extra square footage for storage which in theory, should be offset by not needing to send product into WFS/FBA as early, avoiding their storage fees.

This has been my biggest fixed expense this year, and will be my biggest expense in 2026 as well. Well worth it, however I am still keeping an eye on warehouse options. My personal goal for my business has always been to not need to commute to work though, so I’d much rather relocate somewhere that has a warehouse or workshop on the property, but that can be pretty tough to find in a location that suits me.

Software/Subscriptions: ~$8,000

Nothing surprising here. The bulk of this is made up of Seller Snap which is $6,000 / year, expecting that to increase soon with the Amazon API changes. Luckily they added some value with the Walmart repricer, but that still needs a lot of work. Not a lot of savings I can do here. I switched Marter out for Sellify which in turn allows me to cut RevSeller (saves $100 / yr). I don’t really use inventoryLab anymore except for tracking inventory data, I’ve fully converted to Send to Amazon for shipments. I’m on the fence about cutting it. I added Profit Cyclops into the mix to track Walmart inventory data.

Supplies: ~$7,000

Big ones here are $1,335 on Polybags (I pay a bit more for the non-static and UPC blocking ones from I Love Supplies) and around $4,500 on boxes from Lowes. This is with me making a more conscious effort to re-use boxes. I’d like to get that cost down, and the easiest way to do that would be discounted Lowe’s gift cards. They can be usually found for over 5% off worst case I just need to stop being a bum. I am okay with this number though, because in 2024 I spent $4,600 on boxes and I shipped out thousands and thousands less units. So my re-use box strategy has been working.

Other supplies were things like labels, tape, and bubble pouches. Overall I think this section is pretty healthy, just need to be re-using boxes more often (especially for Walmart since the box dimensional weight is way less impactful than it is on Amazon).

Bookkeeping and Tax Prep: $4,558

I think this is pretty standard for monthly bookkeeping, tax prep fees, and QuickBooks. Nothing I can do here to save money as I like my accountant.

Insurance: $3,109

Pretty standard I think. Unfortunate reality with buy and hold is you need to insure a lot of inventory you have stashed away, often times at multiple locations. This will only keep increasing YoY.

Fuel / Auto Expenses: $6,819

My car is a dedicated work vehicle. Had an expensive year with maintenance since it just crossed 100,000 miles. This should be lower next year, fingers crossed.

Lines of Credit / Balance Transfer / Interest / Loan Fees: ~$26,000

Debt is a hot topic in our space. I will say this: I would not be anywhere close to where I am in terms of profit and size if it weren’t for taking on debt. I’ve used Parafin, Uncapped, Goldman Sachs, Walmart Capital, Slope, and balance transfers all on top of 0% credit cards - whatever it takes to get my hands on as much capital as possible. I’ve reached a point where at any given time I feel like there is something to be bought that substantially beats any sort of fee.

With that being said, not every person should have the same approach.

Here are the facts: I have a 7 year old Amazon account with extremely clean account health. I sell in one, low-risk category with only 1-2 infringements per year and I always beat them. I do FBA only (no FBM). On Walmart, I have a rep who can escalate issues. Only WFS, no seller-fulfilled. I am un-gated in all the major brands I sell on both platforms. I am now majority wholesale and OA and my invoices/receipts are clean.

Basically, if there’s any sort of account that can risk taking on large amounts of debt, it’s someone like me. I have lots of exit strategies and minimal chances of something going wrong.

If you have a fresh account or have un-resolved infringements or don’t have a rep or you’re constantly being restricted in certain brands - your risk tolerance should be much less.

It’s important that if you take on debt, you go in with a plan. Do NOT take on debt and start making sub-optimal purchases just because you have capital. Every time I have taken on debt it has been strategic, usually a massive wholesale deal or buy out of a toy online that has allowed me to have a better hold on the total supply and/or opened new opportunities.

Other Random Expenses (Doesn’t include everything, just some highlights):

Prep Help: ~$4,000 (Had a buddy come down and help prep stuff four or five times this year for a few days at a time)

Cardboard / Pallet Removal: ~$2,000

Security Subscriptions / Equipment: $460

PSA Grading Cards: 3,796.88

My first impressions with all of this is that I do run a really lean ship. No prep center. No VA. No lead lists or cook groups. 99% of prep is done myself other than when my buddy is in town and wants some cash. Really the only way to improve on these fees is just being more organized - that’s what it really comes down to. Finding ways to dodge an extra month or two of storage fees, shipping more efficiently, and continuing to ‘trim the fat’ where possible.

Now let’s dive into what we’re all here for…