Amazon, Walmart, and CPC/Testing Reports

Hello friends,

I had a LEGO theme analysis planned this week but I cannot in good faith encourage LEGO purchasing at the moment (until we have some clarity on the situation at hand).

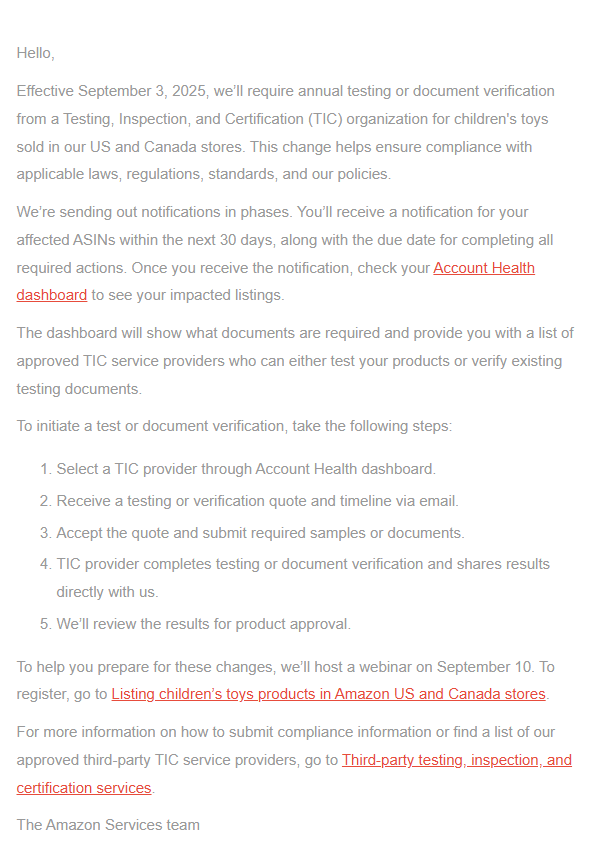

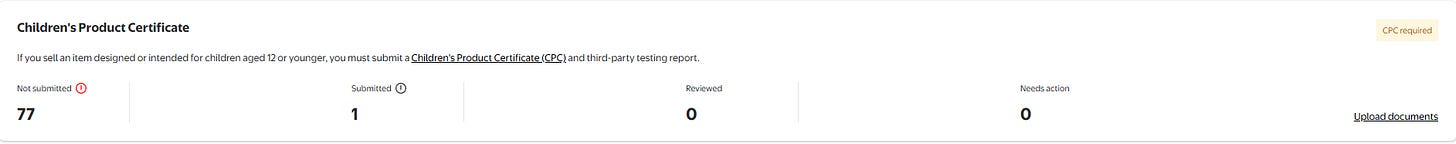

We have a lot to talk about, but for those out of the loop, today we’re going to discuss the Walmart CPC issue that has been ongoing, as well as an additional red flag that popped up yesterday on Amazon:

As you can see, we’re left with a lot of question marks that likely won’t be answered until the September 10 webinar. But with this lingering over our heads, it’s important to be proactive and strategize.

On top of this email, Walmart has been drip feeding CPC requests into our Account Hubs. Up until two days ago, the number of requests was increasing everyday but seems to have now paused.

So with all this chaos and uncertainty around toys, what are we supposed to do?

First of all, let’s figure out why this is happening.

Why is this happening?

The message has been consistent between both platforms. These requests seem to be stemming from their legal teams. This is important to understand because a lot of doom and gloomers will shout from the rooftops that the reason they’re doing this is to destroy online and retail arbitrage.

That is not the case.

In fact, I’d be willing to bet that thought hasn’t even crossed their mind.

Most of the time, when Amazon rolls out some huge policy change, it’s because they need to protect themselves. It isn’t some malicious attempt to kill off arbitrage — arbitrage is just caught in the crossfire.

Now that we understand this, let’s talk about some important questions we need answered.

The important questions

Will these annual CPC requirements continue to be on an ASIN-level basis, or are they switching to offer-level (requiring every individual seller to submit the documents)?

If ASIN-level, will Amazon submit the documents that they have, like they have historically done, or are they still expecting a seller to submit it for the entire listing?

If they are submitting documents that they already have, will they continue to do so even when they are no longer in stock?

Will there be exceptions for major, trusted brands like LEGO, or will they be subject to the same rules? [There are rumors that certain brands may have less requirements or be exempt]

If every brand has to have both CPC and testing reports, but the brand does not provide testing reports, will sellers be responsible for paying for testing every single year?

On which date will the affected toy ASINs actually be unpublished (for both Amazon and Walmart)? [There are rumors that end of September is the deadline for Walmart, TBD for Amazon]

These are some of the burning questions I have that will hopefully be answered on the 10th.

And of course, the question we need to answer ourselves:

What does this mean for the future of arbitrage and exclusives on Amazon and Walmart?

How does this play out?

Everything right now is just theory. We need more information. But I could see this going a few different ways.

The only reason Amazon sent out this update is because they are going to start requiring CPC submissions annually instead of just a one time submission like it is now. Nothing else will change right away. The process will remain ASIN-level. However, this means that once Amazon is sold out of an item, at least one seller on the listing will need to provide the appropriate documents to keep the listing active annually. If the CPC documents and testing reports are not provided, the listing will be unpublished. This will effectively kill off most 12 and under exclusives and will severely damage online and retail arbitrage once Amazon sells out of a product unless someone on the listing is able to acquire the documents. The damage to exclusives will be more pertinent than the damage to RA/OA, because usually someone can get the documents as long as the item has existed in a distributor’s catalog.

or

Amazon follows in Walmart’s footsteps and requires both documents to be submitted by every single seller annually. This effectively kills off all 12 and under exclusives and kills all online and retail arbitrage for most sellers except for people who can get both documents.

Obviously there is a lot of nuance with these, and of course other possibilities, but for the record, I believe the first one is much more likely than the second.

“What should I be doing to prepare?”

I wish I had a crystal ball and could tell you all exactly how this was going to go, but really there is no surefire way to know the ‘optimal’ route right now, until we see Amazon’s webinar.

But here is my belief:

Amazon and Walmart do not want to nuke their catalogs. If they could, they would allow us to sell everything. I expect a sloppy rollout, and some sort of within-TOS workaround in some fashion. I don’t know what that looks like yet, but the fact is that the necessary documents we need already exist. Someone just needs to figure out the best and efficient way to get them.

This isn’t Amazon or Walmart saying, “Hey, you can no longer sell these brands” and red restricting everything. They are just requesting documentation. The documents are out there, or we can even pay for testing ourselves (as mentioned in their outreach).

Someone will find a way to ease the burn. We will likely lose a lot of listings, but I don’t expect it to be as nuclear as the beauty fiasco (unless Amazon goes with option #2 above).

Now with that being said, it is more important than ever to do some self-analysis on your business.

Are you primarily OA and RA with no wholesale accounts? If so, it’s understandable to be more stressed than someone who does wholesale and has an easier time getting the documents. Now would be the time to start opening wholesale accounts and seeing if you can find the items you own in their catalog so you can request documents.

Is your inventory mostly kid toy-esque toys, like Cocomelon, Bluey, etc. and not really collectibles? Then it is understandable to be more stressed because those items will be harder to sell on other platforms vs. something like LEGO or Pokemon or Marvel Legends. If your holds are mostly collectibles, find solace in the fact that you will be able to sell those items on alternate platforms in a worst case scenario.

Is cashflow tight to the point where if your listings were unpublished, your business would struggle to stay afloat? If so, then it is completely reasonable to consider pricing aggressively to move inventory, even at a loss. You cannot run a business on ‘hope’ or ‘maybe’ while waiting for answers. It may be better to generate some cash now and prepare for the worst, even if you’re losing money per sale, to keep your overall business alive.

For me personally:

I do a lot of wholesale. I have access to a lot of the documents I need. Some OA and RA stuff I have I am going to start pricing aggressively to sell just to get some cash back in my pocket. I don’t want to deal with storage, removal fees, etc. I’d rather just get this out of the way now.

For LEGO, I have a hard time seeing Amazon nuking the entire retired LEGO catalog. I am not aggressively pricing LEGO, but I’m also not as worried about the brand as I am things like random Monster High dolls I got at Target or Godzilla toys I got from Walmart. I want those gone, even if I have to lose a $1 or $2.

I am continuing to send in items, even before we see the webinar. Check in times have been decent for me, and I think stuff that I ship out by the 10th can be selling by end of month, and hopefully we have a little bit past that to sell through.

I am pausing purchasing any 12 and under store exclusives or items that do not appear in my distributors’ catalogs. This likely isn’t permanent, but I don’t want to tie up capital on at-risk items currently.

In Closing

I wish I could provide more concrete information, but at this time this is what we have to work with. I will likely wait to release my next toy investing article until after the webinar, unless it’s eBay/Pokemon related since those are not Amazon/Walmart related.

At the end of the day, I still stand by the following:

Discontinued collectibles with strong intellectual property are platform-immune.

This is a headache. Scary. Damaging. Definitely. But I remain confident in my inventory choices that even if Amazon and Walmart didn’t exist, the items I am holding are sought after enough that I could sell them on eBay, WhatNot, locally, etc. Definitely not as fast, but I could still sell them for a profit.

I am stressed, but not panicked. This will be my sixth Q4, and I have never seen a Q4 where some ridiculous rollout didn’t occur around this time. And here’s the thing — it has never turned out as bad as initially thought.

There will always be a way to pivot, and those who want to find a way through these speed bumps will. I am still very confident in the business model and am not straying from my business plan, just being more precise with buying and product selection than ever before while waiting for answers.

Will keep you guys posted as I learn more.

Does anyone know what it will cost to test these? Google says anywhere from hundreds to tens of thousands depending on the thing

Just finished the Amazon webinar and I'm not sure that I'm any wiser... Seems like there's a gray area if toys are from large manufacturers that consistently and rigorously test. However, I have two alerts for items that need testing now and Amazon is the main seller on both listings and both are fairly big companies (Schleich and Goo jit Zu). I'm really interested to hear your take because I'm at a loss